FIX AND FLIP PROGRAMS FOR SEASONED INVESTORS

If you’ve flipped dozens of properties or more, you’ve probably seen it all. Maybe your first few transactions you borrowed money friends, relatives or people that loved you. Maybe you went to a private investor and paid a high rate AND gave them half your profit on the flip. Maybe you didn’t make money on the flip because you didn’t count on “other” expenses. Maybe the contractor you chose to repair did a poor job or overcharged you or both. Well now you know what to look for. Without a doubt, you’re looking for:

* Ease Of Approval

* Attractive Rates

* Attractive Points

* Minimal To No Junk Fees

* NO Surprises!

Some investors might be looking to do a single transaction and some of you might be looking for a line of credit. A line of credit to purchase homes to rehab and flip is not the same as a line of credit you might be thinking of. You can’t go out and buy a Ferrari if you obtain a $1,000,000 line of credit. It basically qualifies you as a borrower and it is based on three things. 1) Level of experience 2) Personal liquidity and 3) Personal credit.

Level of experience – You’ll need to document that you’ve actually either purchased and leased out properties or purchased, rehabbed and flipped properties in the past. That can be in the form of HUD-1’s or showing on previous tax returns the sale of investment properties. The more recent the better.

Personal Liquidity – Lines of credit are basically calculated on a multiple times your own readily available capital, i.e. if you have $250,000 of readily available capital (this can also be a personal LOC with some lenders) you would qualify approximately $1,250,000 in a line of credit. This means that the line of credit is usually around five times (5X) your personal liquidity.

Personal Credit – As you can imagine, personal credit will be important in the equation but not as important as you might think. Some people have high credit scores but with their installment and revolving credit lines maxed, it would not take much to send them into a financial spiral, their personal credit score notwithstanding. It’s great if you have a fantastic credit score, but it’s better if your personal liabilities aren’t substantial.

Don’t confused rate and points with “getting a good deal.” There are fix and flip programs that will offer financing with high single digit rates and low points, but won’t offer higher than 50 – 55% ARV loan amounts, so you’re out of pocket investment is significantly higher than if you had a higher rate / points deal but also with a higher ARV and lower out of pocket investment. Return On Investment (ROI) and Cost Of Funds (COF) are for more important for most people, at least those that know understand the value of it. Your calculator will not lie to you.

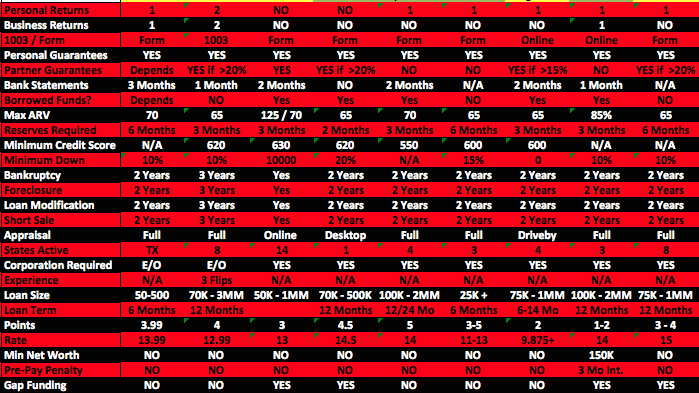

As you can see from the matrix above, there are great variations in all the available programs. If you are a seasoned investor with good credit, it is reasonable to assume that you will get a better terms than someone that is new to flipping or someone with credit that is challenged, but if the numbers from the deal do not work out, it will be moot. With over eighty programs to choose from, we’re certain we can find the correct lender for you.

Below are the normal forms you will need to submit:

Personal Financial Statement (pdf) (Word)

Scope Of Work Budget Form (pdf) (Word)

Completed Rehab Transactions (pdf) (Word)

Real Estate Owned (pdf) (Word)

Residential 1003 Application (pdf) (Word)

Additional information / documents you will need: (Varies by lender)

- Proof of equity (Documentation varies by lender)

- 1-2 Years Personal Tax Returns (Some lenders do not require)

- Purchase / Sale Agreement

- Corporate / LLC Documents (Most lenders require to close in corporate name)

- Identification (Drivers license / social security card, etc.)

- Closing Attorney Contact

- Verification Of Insurance