You know you’ve watched them before. Late night TV and a real estate expert is hawking their course on an informercial about how you can make a fortune in real estate. You see them parade normal working class people showing off their checks how much they made buying a piece of real estate, doing some rehab work on the property and flipping it for a nice profit. It occurs to you that what they made on the flip might be 1/2 or 1/3 what you earn in salary and you think “Hey! I can do this!” And then you do nothing like the majority of people. You have to ask yourself why you did and do nothing? Fear of not making money on the flip? Fear of not finding a buyer? Fear of finding out it needed a lot more repairs than you thought? Fear of not being able to find financing?

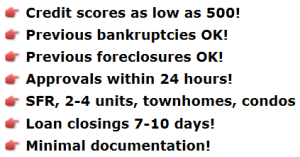

Financing has become available to most any serious investor for fix and flip financing. Do not let your personal credit get in the way of of your personal wealth and your financial independence. These types of loans are approved in days, not weeks or months and close in weeks, not months. The amount of documentation required for approval is minimal. Simply a residential 1003 application, a copy of your credit report with all three scores and some sort of bid / quote from a licensed contractor for any repair costs and that is pretty much to be approved! Believe it or not, there are programs if your credit is poor and you don’t want to submit your credit report! Obviously you want to be responsible with your due diligence and make sure you are purchasing a property with big upside and low downside. Many people with poor credit are in the situation due to no fault on their own such as illnesses, divorce, loss of employment or other factors. Don’t let that get in your way. Don’t let the people who tell you that derogatories on your credit report such as bankruptcies, foreclosures, short sales, loan modifications and judgements will stay on your credit report for seven years prevent you from pursuing your financial dreams!

As you will notice from looking at the matrixes below, the interest rates being charged for fix and flip financing is obviously higher than something that a bank would lend you. But here is the newsflash: The bank isn’t going to lend you money with such minimal documentation and with such speed. These are private funds. These are not regulated by bank examiners so logically will be more aggressive. Do not let the fact that most of these loans are double digit interest rates prevent you from doing these transactions. What is most important is the return on your investment and the cost of funds. If you are going to be selling the property within a few months of acquisition and you’re making interest only payments and then earn five figured profits, don’t let the “what if’s” get in your way. Below you can see different matrixes for fixing and flipping, flipping only and renting only.

We have you covered there too. If you have resources you can approach such as friends, family and relatives, that would obviously be a great option for you; however not everybody has people in their circle of influence that are in a financial position to do so. This is where gap funders come into play. A gap funder is a person or company that provides most of the equity for a purchase and keeps half of the profit after sale of the property. That’s a fair deal don’t you think since you’re providing little to no equity out of your own pocket? I should think so!

Below are the normal forms you will need to submit:

Personal Financial Statement (pdf) (Word)

Scope Of Work Budget Form (pdf) (Word)

Completed Rehab Transactions (pdf) (Word)

Real Estate Owned (pdf) (Word)

Residential 1003 Application (pdf) (Word)

Additional information / documents you will need: (Varies by lender)

- Proof of equity (Documentation varies by lender)

- 1-2 Years Personal Tax Returns (Some lenders do not require)

- Purchase / Sale Agreement

- Corporate / LLC Documents (Most lenders require to close in corporate name)

- Identification (Drivers license / social security card, etc.)

- Closing Attorney Contact

- Verification Of Insurance

Contact us today to discuss your situation and see if fix and flip financing is the appropriate solution for you. If you need something fast, if you need something with minimal documentation, if you need something that is NOT a hassle, then fix and flip financing IS for you.